Trial Balance: Meaning, Objectives, Preparation, Format & Example

Last Updated : 03 May, 2024

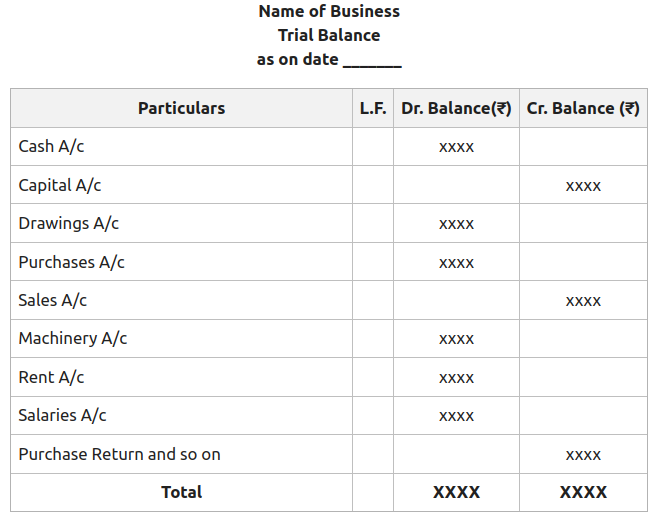

Trial Balance is basically a statement having a debit side and a credit side where all the debit balances of journal entries and ledger postings are recorded on the debit side of the trial balance, and all the credit balances of journal entries and ledger postings are recorded on the credit side of the trial balance. These postings are recorded in the trial balance to verify and check for the correctness of the journal entries and ledger postings. This is because if the debit and credit side of the trial balance agrees, then it is assumed that the journal, subsidiary books, and ledgers are correctly and properly maintained.

The main reason for the trial balance to match is the 'Double Entry System' of accounting. According to the double entry system, every transaction is recorded twice, once on the debit side and the other on the credit side. So, for every debit entry, there is a corresponding credit entry. Though it is not conclusive proof of the correctness of all books of accounts because there can be some errors despite the fact that the total of both sides of the trial balance is matching.

According to Carter - "Trial Balance is the list of debit and credit balances, taken out from ledger. It also includes the balances of cash and bank taken from cash book."

Objectives of Trial Balance

The objectives or the significance of trial balance is as follows:

1. It Summarizes the Ledger Accounts:

Ledger accounts are made to record all the transactions related to the assets, liabilities, expenses, and income of the business with the help of a journal. So, all the debit and credit side balances of ledgers are transferred to the debit and credit side of the trial balance, respectively. So, now from the trial balance, it becomes easy to get concrete information of what is the actual status of the assets, liabilities, expenses or income rather than having abstract access to information. So, trial balance provides the summary for the ledger accounts.

2. It Helps in Determining the Arithmetical Accuracy of the Ledger Accounts:

The aim of the trial balance is to check if all the ledger postings are done in a correct and accurate manner. This can be assessed using the balances of both the debit and credit side of the trial balance. Because if the total on both sides agrees or equates, then it means that ledger postings are posted in an accurate manner. It also confirms the rules of the double entry system that all the entries have a double effect.

3. It Guides in Preparing Final Accounts:

For every businessman, it is important to know the financial health of their business. This can be ascertained by preparing financial accounts like Trading Account, Profit and Loss Account, and Balance Sheet. So, there comes the role of Trial Balance. Once, all the journal entries have been passed, ledger postings have been recorded, and the trial balance matches, then all the financial accounts are prepared, thereby that the balances in the trial balance become the base for recording all the accounting data further in the final accounts.

4. It Helps in Allocating the Errors:

It is important for the trial balance to tally, but if it does not tally, it implies that certainly there are some errors in the books of accounts. So, it would help to first make the businessman aware that maybe a few postings have not been well posted or posted with the wrong amount or in the wrong account, and many other possible errors could be there. So, once the errors are allocated, then corrections could be done to remove the errors.

How to Prepare Trial Balance?

The statement for trial balance can be prepared at any time in the business like at the end of a financial year, for half yearly, at the end of a quarter, or at the end of every month. But most often trial balance is prepared at the end of the financial year so that it can be ensured that books of accounts are maintained with complete accuracy. The statement for trial balance is not prepared as such for a particular period rather it is prepared on a set date. Following are the three methods for preparing the statement for trial balance:

1. Balance Method

While preparing the statement of trial balance under this method, all the ledger accounts with the debit balances are carried forward to the debit side of the trial balance and all the ledger accounts with the credit balances are carried forward to the credit side of the trial balance. As the name suggests, it is a method related to the balances, so the balances are available in the ledger account at the end after all the adjustments are carried forward to the trial balance. Also, if any of the ledger accounts do not show any balance i.e. the total on both the debit and the credit side is the same, then there is no need to carry it to the trial balance. So, in the end, if the debit and credit side of the trial balance matches, it can be said that the trial balance has been well prepared.

2. Total Amount Method

While preparing the statement of trial balance under this method, unlike the balance method, not only balances rather the total amount on the debit side of the ledger account is transferred to the debit side of the trial balance and the total amount on the credit side of the ledger account is transferred to the credit side of the trial balance. Under this method, the statement for trial balance can be prepared promptly after posting all the entries to ledger accounts before any adjustments are made to them.

3. Total-cum-Balances method

Under this method, two methods - 'Balance Method' and 'Total Amount Method' are combined to prepare the statement of trial balance. It implies that in total, four columns are prepared, two columns are for recording the debit and credit balances of ledger accounts and two columns are for recording the debit and credit totals of various ledger accounts. This method is rarely used and not so frequently used while making the statement for the trial balance.

Example of Trial Balance

Following are the ledger balances of Ram Das Pvt. Ltd. as on the date 31 March, 2022. Prepare the Trial Balance using the following balances.

Solution:

Similar Reads

CBSE Class 11 Accountancy Notes Accountancy is a practice through which business transactions are recorded, classified, and reported for the proper and successful running of an organization. GeeksforGeeks Class 11 Accountancy Notes have been designed according to the CBSE Syllabus for Class 11. These revision notes consist of deta

8 min read

Part A

Chapter 1: Introduction to Accounting

Introduction to AccountingWhat is Accounting?The American Institute of Certified Public Accountants(AICPA) defines Accounting as the art of recording, classifying, and summarizing the transactions and events that are in monetary terms efficiently and effectively and interpreting the results. The main aim behind the accountin

6 min read

Types and Users of Accounting InformationAn organisation's financial information is recorded, examined, summarised, and interpreted through the accounting process. Accounting Information is needed by stakeholders of the firm, including the employees, owners, creditors, banks and other lenders, regulatory agencies, and tax authorities, amon

4 min read

Difference between Bookkeeping and AccountingBookkeeping and Accounting are two different processes in Accountancy. They are the two fundamental aspects of financial management, but they serve different purposes and involve different tasks. Bookkeeping is the process of systematically maintaining records or books of accounts of an organization

5 min read

Accounting: Objectives, Characteristics, Advantages, Disadvantages and Role of AccountingThe American Institute of Certified Public Accountants(AICPA) defines accounting as an art of recording, classifying, and summarising the transactions and events that are in monetary terms efficiently and effectively and interpreting the results. The main aim of the accounting process is the ascerta

9 min read

Basic Accounting TermsAccounting is the process of measuring and recording all the financial transactions that happened in a financial year. It includes summarizing, analyzing and recording the data. It helps in getting a clear picture of the financial position of the business by seeing the value of a company’s assets an

15+ min read

Difference between Accounting and AccountancyAccounting and Accountancy are often considered as one and the same; however, these are two different concepts.What is Accounting?Accounting is simply the process of recording all the business transactions of a financial year, it starts where the bookkeeping gets stops.Accounting can be defined as t

4 min read

Chapter 2: Theory Base of Accounting

Chapter 3: Recording of Business Transactions

Accounting Voucher: Format & Types of VouchersIn a business, there are numerous transactions that take place on regular basis, these can be the purchase and sale of goods and services, receiving or paying cash, and many more. Transaction basically refers to any monetary activity that affects the financial statements and is documented as an entr

6 min read

Accounting Equation: Meaning, Formula, Components & CalculationThe accounting equation is the foundation of double-entry accounting, representing the relationship between a company's assets, liabilities, and equity. Business is run through transactions. Transactions are financial in nature and they affect the financial position of any business. Every transactio

4 min read

Accounting Equation | Increase in Assets and Capitals both and Increase in Assets and Liability bothAccounting equation is based on the principle of dual aspect concept of accountancy because it holds true to the change that occurs due to any transaction taking place. A transaction can affect both sides of the equation by the same amount or any one side of the equation only, by both increasing or

2 min read

Accounting Equation | Decrease in Assets and Capital both and Decrease in Asset and Liability bothEvery Accounting transaction affects at least two accounts simultaneously. These effects can be both positive and negative, depending upon the nature of the transaction. Some of the transactions that negatively affect the assets, liability, and capital are being discussed below:- 1. Decrease in Asse

2 min read

Accounting Equation|Decrease in Capital and Increase in the Liability, Decrease in Liability and Increase in the Capital and Increase and Decrease in AssetsEvery accounting transaction, at a minimum, affects two accounts at the same time, either positively or negatively. Accounting Transaction that causes an increase in capital and decrease in liability, and increase and decrease in assets have been mentioned below:1. Decrease in Capital and Increase i

3 min read

Accounting Equation|Sale of Goods and Calculation of Net Worth (Owner's Equity) Or CapitalEvery business unit sells goods for cash or on credit and sometimes at a profit or loss accordingly. When a good is sold either at a profit or a loss, along with asset and liability accounts, the capital account is also affected simultaneously. In the case of profit, the amount of profit is added to

5 min read

Journal EntriesA Journal is a book in which all the transactions of a business are recorded for the first time. The process of recording transactions in the journal is called Journalising and recorded transactions are called Journal Entries.Every transaction affects two accounts, one is debited and the other one i

15+ min read

Journal Entry Questions and SolutionsA journal is a book of original entries in which transactions are recorded, as and when they occur. The journal provides data-wise records of all the transactions and the amount of each transaction. Everyday transactions are recorded in a journal chronologically, giving a complete picture of the tra

4 min read

Rules of Journal Entry in AccountingWhat is a Journal?A Journal is a book in which all the transactions of a business are recorded for the first time. We know that every transaction affects two accounts, one is debited and the other one is credited. 'Debit' (Dr.) and 'Credit' (Cr,) are the two terms or signs used to denote the financi

5 min read

Cash Book: Meaning, Types, and ExampleWhat is a Cash Book?A Cash Book is an Original Entry (or Prime Entry) book in which all cash and bank transactions are documented chronologically. When the business is small, it is easy to record every transaction in a single book called a 'Journal'. Journal is also known as the book of original ent

7 min read

Purchase Book : Meaning, Format, and ExampleWhat is a Purchase Book?Purchase Book is prepared by the firms to record the credit purchase of goods. Purchase of goods for cash and purchase of other things other than goods are not recorded in the purchase book. Cash purchases are recorded in Cash Book and other things are recorded in Journals an

3 min read

Sales Book: Meaning, Format and ExampleBusiness these days had grown immensely. With the growth of the firms, the number of transactions in the business has also increased. The transactions in a business are of different natures and affect different accounts. So, it is impossible to record all the transactions in one place, i.e., 'Journa

5 min read

Purchase Return Book : Meaning, Format, and ExampleWhat is a Purchase Return Book? The Purchase Return Book refers to the subsidiary book where the record of the 'return of goods purchased on credit' is maintained. It is also called as 'Return Outward Book'. There could be a number of factors for which the suppliers might return the goods that they

6 min read

Sales Return Book: Meaning, Format, and ExampleWhen the business is small, it is easy to record every transaction in a single book called 'Journal'. Journal is also known as the book of original entry. But gradually when the business expands, it becomes inconvenient to record such a large number of transactions in a single book. So, the book of

6 min read

Journal Proper: Meaning, Format and ExamplesWhat is Journal Proper?Journal Proper is the book that is maintained to record those transactions which are not recorded in the special books. Transactions that do not find a place in any other subsidiary book, such as Cash Book, Purchase Book, Sales Book, Bills Payable Book, Purchase, and Sales Ret

4 min read

Ledger | Meaning, Format, Example and Balancing of AccountsWhat is Ledger? A Ledger records transactions from the journal and forms separate accounts for them in chronological order. A Ledger is a date-wise record of all the transactions related to a particular account. Ledgers are crucial sources of financial records. A ledger is formed after the journal a

3 min read

Chapter 4: Bank Reconciliation Statement

Chapter 5: Depreciation, Provisions, and Reserves

Depreciation: Features, Causes, Factors and NeedDepreciation refers to the decrease in the value of assets of the company over a time period due to use, wear and tear, and obsolescence. In others words, it is the method to allocate the cost of an asset over its useful life. Depreciation is always charged on the cost price of the asset and not on

6 min read

Methods of charging DepreciationDepreciation refers to the decrease in the value of assets of the company over the time period due to use, wear and tear, and obsolescence. In others words, It is the method to allocate the cost of an asset over its useful life. Depreciation is always charged on the cost price of the asset and not o

5 min read

Straight Line Method of Charging DepreciationBusinesses choose different methods for calculating depreciation according to their need. One of the most prominent methods for calculating depreciation is the Straight Line Method. Under this method of charging depreciation, the amount charged as depreciation for any asset is fixed and equal for ev

3 min read

Written Down Value (WDV) Method of DepreciationBusinesses choose different methods for calculating depreciation according to their need. One of the most prominent methods for calculating depreciation is the Written Down Value Method. Under this method of charging depreciation, the amount charged as depreciation for any asset is charged at a fixe

3 min read

Difference between Straight Line and Written Down Value Method of calculating DepreciationThe word "depreciation" comes from the Latin word 'depretium' where 'De' means decline and 'pretium' means price. Thus the word 'depretium' stands for the decline in the value of assets. Depreciation refers to the decrease in the value of assets of the company over the time period due to use, wear a

4 min read

Difference between Depreciation and AmortizationDepreciation and Amortisation are two different concepts used in accounting to calculate the value of an asset. Depreciation is a method to reduce the value of fixed assets due to wear & tear whereas amortisation is dividing the cost of an asset over the number of years of its life. Depreciation

3 min read

Provisions in Accounting - Meaning, Accounting Treatment, and ExampleA provision in accounting refers to an amount that has been set aside from the profits of the business in order to meet an unanticipated loss. All business units set aside some part of their current year's profits in order to "provide" for some certain unforeseen financial crunch that may arise in t

2 min read

Reserves in Accounting: Meaning, Accounting Treatment, Importance, and ExampleFor any organisation, it is important to enjoy a sound and strong financial position. A sound financial position helps the business to meet up all the contingencies which can be anticipated or unanticipated. So, it is always preferable for the business to not distribute all the profits to the owners

8 min read

Reserves and its TypesAny amount of money that has been set aside for certain purposes or reasons in a business is termed a reserve. In businesses, generally, a part of earnings is kept aside for unforeseen financial situations. This reserve may be used for renovation of the offices, purchasing new machines and new softw

4 min read

Difference between Capital Reserve and Revenue ReserveIn common terms, a Reserve is anything retained for the future. Similarly, in Accountancy, Reserve means a part of the profit that has been retained and kept aside by the companies to meet their future needs. Reserves strengthen the financial position of the companies and make them more competitive.

3 min read

Chapter 6: Trial Balance and Rectification of Errors

Chapter 7: Bills of Exchange

Bills of Exchange: Meaning, Features, Parties, and AdvantagesWhat is Bill of Exchange?A bill of exchange is a written order that one party receives from another requiring them to pay the other a specific amount of money, either immediately or at a later date. It is important that such an order of payment should be unconditional and be accepted by both parties

4 min read

Promissory Note: Features and PartiesWhat is a Promissory Note?When the purchaser of the goods or debtor of any business himself writes a note, signs it, and gives it to the seller of the goods, the note signed by the debtor becomes a promissory note. It can also be described as a verbal or written unconditional promise by the debtor t

3 min read

Difference between Bills of Exchange and Promissory NoteBills of Exchange and Promissory Notes are two different concepts of accountancy.What is Bills of Exchange?Bills of Exchange is a written document that binds one party to pay a certain amount to another party on demand or on the expiry of a fixed period of time. There are three parties to the bills

4 min read

Important Terms in Bills of ExchangeWhat is Bill of Exchange?A bill of exchange is a very popular negotiable instrument. It is a written order drawn upon one party by the other, whereby the former is required to pay a stipulated sum of money to the latter, either on the latter's demand or at some point in the future. It is noteworthy

9 min read

Accounting Treatment of Bills of ExchangeWhat is a Bill of Exchange?A bill of exchange is a written order that one party receives from another requiring them to pay the other a specific amount of money, either immediately or at a later date. It is important that such an order of payment should be unconditional and be accepted by both parti

2 min read

Part B