Past Adjustments in Partnership Accounting | Cases & Examples

Last Updated : 21 Apr, 2025

In a Partnership, the profit is divided among partners according to the conditions mentioned in the partnership deed. For example, according to the conditions of the Partner's Salary, Interest on Capital, etc. Even though there are conditions, sometimes partners forget to fulfil them or make some errors in fulfilling these conditions. Past Adjustments are made to correct all the errors made in the partnership accounting. Some of these errors are as follows:

- Interest not given on partner's loan

- Interest on capital wrongly calculated or not paid

- Wrong profit-sharing ratio

- Interest on drawings not charged or charged at the wrong rate

- Salary or commission paid to a partner without considering whether or not the partner is entitled to it

Because of the above-mentioned errors, the profits are wrongly distributed among the partners. Hence, it becomes necessary to adjust this through the capital accounts before or after the closure of accounts.

Adjustments before Closing Accounts:

Sometimes a company finds errors before the accounts are closed. The adjustment of such errors is made before the closure of accounts.

Adjustments after Closing Accounts:

Sometimes a company finds after the closure of accounts that any condition provided for in the partnership deed has not been fulfilled or a mistake has been made. In these situations, the company does not reopen the accounts in the following year to rectify the mistake or error instead adjustment entries are passed through the partner's capital accounts. Before passing the adjustment entries, it has to determine which partner has received an extra share of profit and which partner has received less. Ultimately, the account of partner who has received an extra amount is debited, and the account of partner who has received a less amount is credited.

Steps for the Calculation of Amount of Past Adjustment Entry

The steps are as follows:

Step 1: The first step is to determine the amount which should have been credited by way of interest on capital, salary, commission, share of profit, etc.

Step 2: In the second step, the amount already credited by way of interest on capital, salary, commission, share of profit, etc., is calculated.

Step 3: The next step involves calculation of the difference between the amounts calculated in the above two steps.

Step 4: After calculating the difference, the company has to find out which partner has received excess and which partner has received short.

Step 5: The last step of calculation of amount of adjustment entry involves passing the adjusting journal entry by debiting the Capital A/c of the partner who has received excess amount and crediting the Capital A/c of the partner who has received short.

Case 1: When Interest on Capital is less Charged:

Example:

Gaurav, Kashish, and Vaibhav are partners in a firm sharing profits and losses in the ratio of 2:3:1. Their fixed capitals were ₹6,00,000; ₹2,00,000 and ₹4,00,000, respectively. Interest on capital for the year 2020-21 was credited to them @ 9% p.a. instead of 10% p.a. The profit for the year after charging interest was ₹5,00,000. Prepare the Adjustment Table and pass the Adjustment Entry.

Solution:

Case 2: When Interest on Capital is more Charged:

Example:

Sahil, Vishal, and Anand are partners in a firm sharing profits and losses in the ratio of 2:1:2. Their fixed capitals were ₹3,00,000; ₹6,00,000, and ₹12,00,000, respectively. Interest on capital for the year 2020-21 was credited to them @ 10% p.a. instead of 8% p.a. The profit for the year after charging interest was ₹6,00,000. Prepare the Adjustment Table and pass the Adjustment Entry.

Solution:

Case 3: When Interest on Capital is not Charged:

Example:

Sukant and Bijay are partners in a firm sharing profits and losses in the ratio 3:5. Their fixed capitals were ₹10,00,000 and ₹18,00,000, respectively. After the closing of accounts of the year, it was found that interest on capital @10% p.a. as provided in the partnership deed has not been credited to the Capital Accounts of the partners. Pass a necessary journal entry to rectify the error.

Solution:

Case 4: When Interest on Drawings is not Charged:

Example:

Akanksha, Sayeba, and Nupur are partners in a firm sharing profits and losses in the ratio 3:2:1. After the final accounts of the firm have been prepared, it was discovered that interest on drawings had not been taken into consideration. The interest on drawings of the partners was ₹500, ₹350, ₹200, respectively. Pass a necessary journal entry to rectify the error.

Solution:

Case 5: When Profit is already distributed in deed ratio without adjustment of Interest on Capital, Salary, Commission, and Interest on Drawings:

Note: If Profit is given then it is taken on Adjustment.

Example:

The net profit of a firm for the year ended 31st March 2020 was ₹1,20,000, which has been duly distributed amongst its partners Hardik, Sumit, and Shubham in their agreed proportions of 2:1:1, respectively. It was discovered on 10th April 2020 that the undermentioned transactions were not passed through the books of accounts of the firm for the year ended 31st March 2020, which stood duly closed on that date:

- Interest on Capital @ 10% p.a.

- Interest on Drawings: Hardik ₹1,400; Sumit ₹1,000; Shubham ₹600.

- Salary of ₹20,000 to Hardik and ₹30,000 to Sumit.

- Commission due to A on a special transaction, ₹12,000

The capital accounts of the partners on 1st April 2019 were: Hardik ₹1,00,000; Sumit ₹80,000; Shubham ₹60,000. Suggest a journal entry that should be passed on 10th April 2020 that will not affect the Profit & Loss Account of the firm for 2019-20 and at the same time rectify the position of the partners.

Solution:

Case 6: When Profit already distributed in wrong ratio without adjustment of Interest on Capital, Salary, Commission, and Interest on Drawings:

Example:

Ishika, Harshita, and Astha are partners in a firm with capital as ₹1,20,000; ₹60,000; and ₹60,000, respectively on 1st April 2021. As per the provisions of the deed:

- Astha was to be allowed a remuneration of ₹12,000 p.a.

- Interest at 5% p.a. was to be provided on capital.

- Profits were to be divided in the ratio of 3:1:1.

Ignoring the above terms, net profit of ₹72,000 for the year ended 2021-22 was divided among the partners equally. Prepare the Adjustment Table and pass an Adjustment Entry to rectify the error.

Solution:

Case 7: Computation of Opening Capital (When Interest on Capital is not Given):

Example:

Anshul, Abhinav, and Navya are partners in a firm sharing profits and losses in the ratio of 2:3:5. After division of the profit for the year ended 31st March 2022 their capitals were ₹1,00,000; ₹1,20,000; and ₹1,40,000. During the year, they withdraw ₹40,000 each. The profit of the year was ₹40,000. The partnership deed provided that interest on capital will be allowed @10% p.a., but while preparing the final accounts interest on partners' capital was not allowed. Calculate the capital of Anshul, Abhinav, and Navya on 1st April 2021 and pass the necessary journal entry for providing Interest on Capital.

Solution:

Case 8: Changes in Profit Sharing Ratio:

Example:

Nisha, Shreya, and Kanika were three partners in a firm sharing profits and losses in the ratio 1:3:4, respectively. Nisha wants that she should share equally in the profit with Shreya and Kanika, and she further wants that the change in profit-sharing ratio should come adjustment into effect, respectively for the last three years. Shreya and Kanika have no objection to this. The profit for the last three years were ₹10,000, ₹12,000 and ₹14,000. Show the adjustment of profit for the last three years with the help of journal entries.

Solution:

Working Notes:

Total Profit of the last 3 years = 10,000 + 12,000 + 14,000

= ₹36,000

Case 9: When Partnership Deed is not maintained:

Example:

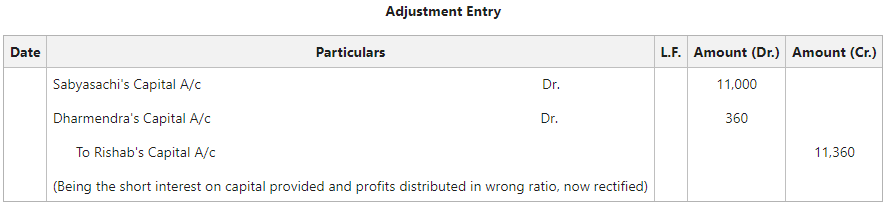

The capitals of Sabyasachi, Dharmendra, and Rishab as on 31st March 2021 amounted to ₹60,000; ₹2,20,000; and ₹4,40,000, respectively. The profits for the year 2020-21 was ₹1,20,000 and was distributed in the ratio 3:2:1 after allowing Interest on Capitals @ 10% p.a. During the year, each partner withdrew ₹80,000. The partnership deed was silent as to profit sharing ratio but provided for Interest on Capital @ 12%. Pass the necessary adjustment journal entry.

Solution:

Working Notes:

Calculation of Interest on Capital already provided and Opening Capitals:

Case 10: Adjusting Entry when Manager is treated as a Partner:

Note: Revised profit for calculation Share of Profit = Given Profits + AMount already given as Manager - Amount to be given as Partner

Example:

Arun and Anurag are partners sharing profits and losses in the ratio of 5:4. They employed Bhavook as their manager to whom they paid a salary of ₹1,500 per month. Bhavook has deposited ₹40,000 on which interest was payable @9% p.a. At the end of 2020-21 (after division of the year's profits), it was decided that Bhavook should be treated as a partner with effect from 1st April 2017-18 with 1/6th share of profits, his deposit being considered as capital carrying interest at 6% p.a. like capitals of other partners. The firm's profits and losses after allowing interest on capitals were: 2017-18 Profit ₹1,18,000; 2018-19 Profit ₹1,25,200; 2019-20 Loss ₹8,000; 2020-21 Profits ₹1,56,000. Record the necessary Journal Entries to give effect to the above.

Note: Interest on Capital is to be allowed as a charge

Solution:

Share of Bhavook as a partner is ₹82,800, which is more than ₹57,600; i.e., ₹25,200. Therefore, Bhavook will be credited with ₹25,200, and Arun & Anurag will be debited in 5:4 ratio with ₹25,200.

Similar Reads

CBSE Class 12 Accountancy Notes Accountancy is a practice through which business transactions are recorded, classified, and reported for the proper and successful running of an organization. GeeksforGeeks Class 12 Accountancy Notes have been designed according to the CBSE Syllabus for Class 12. These revision notes consist of deta

15 min read

PART-A

Chapter 1: Accounting for Partnership: Basic Concepts

Introduction to Accounting for PartnershipA partnership generally means a relationship among people sharing a mutual interest. In accountancy, a partnership means a business set up together by two or more persons sharing a common interest to earn profit. The concept of partnership is a solution to the problems of the sole proprietorship, su

8 min read

Partnership Deed and Provisions of the Indian Partnership Act 1932Partners are two or more people who agree to carry on a business and share the profits and losses of the business. They are persons who join hands together with a common interest to start a business and share its future profits or losses. Partnership defines the state of being associated with the pa

5 min read

Difference between Limited Liability Partnership and Partnership FirmLimited Liability Partnership and Partnership Firm are two different concepts. The former is a form of organisation; however, the latter is a relationship among people who share mutual interest.What is a Limited Liability Partnership?A Limited Liability Partnership is a form of partnership where all

4 min read

Accounting Treatment for Interest on Partner's CapitalInterest on Capital is an interest allowed to the partners on the capital amount invested by them into the firm. Such interest is not paid in cash, instead the partner's capital account is credited by the same amount. Interest on Capital is paid by the firm and is therefore an expense for the firm t

4 min read

Interest on Drawing in case of PartnershipInterest on Drawings is an interest charged on the amount withdrawn by the partners for personal use. Such interest is an income for the firm and an expense for the partners, and hence is credited to the Profit and Loss Appropriation Account of the firm and is deducted from the partner's Capital/Cur

4 min read

Accounting Treatment of Partner's Loan, Rent Paid to a Partner, Commission Payable to a Partner, Manager's Commission on Net ProfitPartner's Loan:Partner's Loan is created to Partner's Loan Account and not to Partner's Capital A/c. A Loan advanced by any partner is a charge against profit and not an appropriation of profit. According to the Indian Partnership Act,1932, Partner's Loan is repaid in priority to capital at the time

4 min read

Profit and Loss Appropriation Account : Journal Entries & FormatProfit and Loss Appropriation Account is prepared by a partnership firm to appropriate the net profit of the accounting year among the partners. Profit and Loss Appropriation Account is affected by the Partnership Deed or the Partnership Act. It is an extension of the Profit and Loss Account, and th

5 min read

Difference between Profit and Loss Account And Profit and Loss Appropriation AccountIn the words of Prof. Carter "A Profit and Loss Account is an account into which all gains and losses are collected in order to ascertain the excess of gains over the losses or vice-versa."What is a Profit and Loss Account?Profit and Loss Account is prepared by every organisation to know about the p

3 min read

Capital Accounts of the Partner: Fixed Capital MethodThe Partner's Capital Account is an account that records all the transactions between the Partnership firm and the partners to evaluate the partners' share in the firm (Partners' investment) at the end of the accounting period. The partners' capital account is adequately maintained to ensure transpa

4 min read

Capital Accounts of the Partner: Fluctuating Capital MethodThe Partner's Capital Account is an account that records all the transactions between the Partnership firm and the partners. The Capital Account is prepared to determine the partners' share in the firm at the end of the accounting period. Every item of the partner's concern, right from their initial

4 min read

Difference between Fixed Capital Account and Fluctuating Capital AccountThe Partner's Capital Account is an account that records all the transactions between the Partnership firm and the partners. The Capital Account is prepared to determine the partners' share in the firm at the end of the accounting period. Every item of the partner's concern, right from their initial

4 min read

Past Adjustments in Partnership Accounting | Cases & ExamplesIn a Partnership, the profit is divided among partners according to the conditions mentioned in the partnership deed. For example, according to the conditions of the Partner's Salary, Interest on Capital, etc. Even though there are conditions, sometimes partners forget to fulfil them or make some er

8 min read

Guarantee of Minimum Profit to a Partner: Journal Entries & ExampleGuarantee of Minimum Profit to a Partner means that a partner has been assured to receive a minimum amount of profit (Guaranteed Amount). This further means that if in any year, the actual share of the profit of the guaranteed partner is less than the Guaranteed Amount, then the deficiency shall be

4 min read

Chapter 2: Reconstitution of a Partnership Firm: Change in Profit Sharing Ratio

Reconstitution of a Partnership Firm : Reasons and Change in Profit Sharing RatioWhat is Reconstitution of a partnership firm?Reconstitution of a partnership firm refers to a change in the structure of a partnership business. This change can occur as a result of several factors, such as the admission of new partners, retirement of existing partners, or the death of a partner. Re

7 min read

Goodwill: Meaning, Factors Affecting Goodwill and Need for ValuationWhat is Goodwill?Goodwill is an intangible asset that represents the market value of a business firm. In simple words, Goodwill is a monetary value of a reputation of a business firm in the market, earned by the owner through his/ her hard work and best quality service. Goodwill of the firm enables

7 min read

Valuation of Goodwill: Meaning, Methods, Formulas & ExamplesA firm's Goodwill is the reputation earned by the firm through rendering quality services to its customers. A satisfied customer will come back to the firm again and again thereby, helping the firm to build up a solid customer base that yields more profit in the future. Thus, Goodwill is the market

11 min read

Average Profit Method of calculating GoodwillGoodwill can be defined as the value of the business. It is the intangible asset of the business. An enterprise earns more profit than the normal profit because of Goodwill. Goodwill can be defined as the reputation of the business earned through hard work, honesty, quality, and customer satisfactor

4 min read

Super Profit Method of Calculating GoodwillGoodwill is the intangible asset of the business. An enterprise earns more profit than the normal profit because of Goodwill. Goodwill can be defined as the reputation of the business earned through hard work, honesty, quality, and customer satisfactory services. It helps to earn profits in the futu

4 min read

Capitalisation Method of Calculating GoodwillIn a common language, Goodwill means a 'reputation' or a 'good name'. Therefore, a Partnership firm's Goodwill is the reputation earned by the firm through rendering quality services to its customers. A satisfied customer will return to the firm, again and again, helping the firm build up a solid cu

5 min read

Accounting Treatment of Accumulated Profits and Reserves: Change in Profit Sharing RatioWhen the firm is reconstituted all the accumulated profit, reserves and losses are transferred to Partner's Capital Accounts (if capitals are fluctuating) or Current Accounts (if capitals are fixed) in their old profit-sharing ratio. This is done because the reserves or accumulated profits/losses be

2 min read

Change in Profit Sharing Ratio: Accounting Treatment of Investment Fluctuation FundAll business units create reserves out of their profits from each year to allot such money for specific purposes. They are usually created to buy fixed assets, pay bonuses, pay an expected legal settlement, pay for repairs & maintenance and pay off debt. Thus, reserves help a company stay financ

3 min read

Accounting Treatment of Revaluation of Assets and Liabilities: Change in Profit Sharing RatioThe value of Assets and Liabilities undergoes a change with the passage of time due to many reasons, like regular wear and tear, appreciation in the value of assets, bankruptcy of any debtor, and so on. In the Partnership firm, whenever there is a change in the profit-sharing ratio among the partner

8 min read

Accounting Treatment of Partner's Capital Account in case of change in Profit Sharing Ratio (Fixed Capital)Capital is the amount contributed by the partners in the firm. Partner’s capital shows equity in a partnership that is owned by specific partners. It records the initial and subsequent contribution made by each partner and also the withdrawal made by the partner. Partner’s Capital Account shows the

4 min read

Accounting Treatment of Partner's Capital Account in case of change in Profit Sharing Ratio (Fluctuating Capital)Capital is the amount contributed by the partners in the firm. Partner’s capital shows equity in a partnership owned by specific partners. It records the initial and subsequent contribution made by each partner and also the withdrawal made by the partner. Partner’s Capital Account shows the ownershi

4 min read

Adjustment in Existing Partner's Capital Account in case of Change in Profit Sharing RatioChange in profit-sharing Ratio or reconstitution of firm results in adjustment of capital accounts of the partners. The capital of the new firm is adjusted with respect to the new profit-sharing of the partners in the firm. When there is a change in the profit-sharing ratio or reconstitution of the

3 min read

Chapter 3: Reconstitution of a Partnership Firm: Admission of a Partner

Computation of New Profit Sharing Ratio: Admission of a PartnerNew profit sharing means the ratio in which all the partners including the new partner will share future profit and loss of the business. When a new partner is admitted into the business, he becomes entitled to share in future profits and losses of the business. The new partner admitted will have to

7 min read

Computation of Sacrificing Ratio in case of Admission of a PartnerSacrificing Ratio is the ratio in which the old partners sacrifice their share of profit and loss in the firm for the new partner admitted. During the time of admission of new partners, there is a change in the profit sharing ratio. There is a change in the profit sharing ratio because the new partn

8 min read

Accounting Treatment of Goodwill in case of Admission of a PartnerWhat is Goodwill?Goodwill is an intangible asset that is either self-generated or purchased. It is the value of benefits that a business has because of the factors that help in increasing its profitability, say its location, favourable contracts, access to supplies and customer loyalty, etc. Goodwil

6 min read

Hidden Goodwill: Admission of a PartnerGoodwill is an intangible asset that is either self-generated or purchased. It is the value of benefits that a business has because of the factors that help in increasing its profitability say its location, favourable contracts, access to supplies and customer loyalty, etc. Goodwill is the reputatio

4 min read

Accounting Treatment of Revaluation of Assets and Liabilities in case of Admission of a PartnerThe value of Assets and Liabilities undergoes a change with the passage of time due to many reasons, like regular wear and tear, appreciation in the value of assets, bankruptcy of any debtor, and so on. In a Partnership firm, when a new partner is admitted into the business, it becomes necessary to

7 min read

Accounting Treatment of Accumulated Profits and Reserves in case of Admission of a PartnerWhen a new partner is admitted in a partnership firm, all the accumulated profit, reserves, and losses are transferred to Partner’s Capital Accounts (if capital is fluctuating) or Current Accounts (if capital is fixed) in their old profit-sharing ratio. This is done because the reserves or accumulat

2 min read

Accounting Treatment of Workmen Compensation Reserve: Admission of a PartnerWorkmen Compensation Reserve is the reserve created out of profits to meet the needs of employees or workers. An amount is kept aside in the reserve in name of workers to meet the unforeseen situation. A claim can or cannot be made against this reserve. Accounting treatment differs for situations ag

4 min read

Accounting Treatment of Investment Fluctuation Fund in case of Admission of a PartnerAn investment Fluctuation Fund is a reserve created out of profit to meet the change in the market value of the investment. Â An amount is kept aside in the reserve in name of fluctuation to meet the change in the value of the investment. The difference between the book value and the market value of

6 min read

Accounting Treatment of Partner's Capital Account: Admission of a Partner (Fixed Capital)Capital is the amount contributed by the partners in the firm. Partner's capital shows equity in a partnership that is owned by specific partners. It records the initial and subsequent contribution made by each partner and also the withdrawal made by the partner. Partner's Capital Account shows the

5 min read

Accounting Treatment of Partner's Capital Account: Admission of a Partner (Fluctuating Capital)Capital is the amount contributed by the partners in the firm. Partner's capital shows equity in partnership that is owned by specific partners. It records the initial and subsequent contribution made by each partner and also the withdrawal made by the partner. Partner's Capital Account shows the ow

5 min read

Preparation of Revaluation Account, Capital Account and Balance SheetIllustration 1:Amit and Sumit were partners sharing profit equally. A new partner, Ravi is admitted from 1st April 2022 for a  \frac{1}{5}th of the share in the profit. Following is the Balance Sheet of Amit and Sumit as on 31st March 2022: Additional Information:Ravi brought ₹40,000 as his Capital

3 min read

Adjustment of Partner's Capital Account: Admission of a PartnerWhenever a new partner is admitted, he/she brings an amount as capital either in proportion to his share of profit or the capital of old partners is adjusted to make them proportionate to their share of profits respectively. Such adjustment of capital can be done in either of the following ways:Case

5 min read

Chapter 4: Reconstitution of a Partnership Firm: Retirement or Death of a Partner

Retirement of a Partner in case of Reconstitution of a Partnership FirmWhen a partner retires or dies, the previous partnership deed expires, and a new partnership deed must be drafted to allow the surviving partners to continue doing business on new terms and circumstances. The accounting procedure differs a little depending on whether the employee retires or dies. In

4 min read

Computation of New Profit Sharing Ratio: Retirement of a PartnerWhenever a partner retires from a firm, his/her share of profit is acquired either by all the remaining partners or some/ one of them. This leads to a change in Profit-Sharing Ratio among the continuing partners, and therefore, a New Profit-Sharing Ratio for each remaining partner is determined. A N

4 min read

Calculation of Gaining Ratio: Retirement of a PartnerWhat is Gaining Ratio?When a partner retires from a firm, his share of the profit is acquired by the continuing partners in a certain ratio, and a new profit-sharing ratio is determined. A Gaining Ratio is a ratio in which the remaining partners take over the share of the retiring partner. The purpo

5 min read

Difference between Sacrificing Ratio and Gaining RatioAfter the admission of a new partner or retirement or death of old partners in a partnership business, the new profit sharing ratio is calculated for all the remaining partners of the business. The new profit sharing ratio brings a change in the ratio in which partners were previously distributing t

4 min read

Accounting Treatment of Goodwill in case of Retirement of a PartnerWhat is Goodwill?Goodwill is an intangible asset that is either self-generated or purchased. It is the value of benefits that a business has because of the factors that help in increasing its profitability, say its location, favourable contracts, access to supplies and customer loyalty, etc. Goodwil

5 min read

Hidden Goodwill in case of Retirement of a PartnerGoodwill is an intangible asset that is either self-generated or purchased. It is the value of benefits that a business has because of the factors that help in increasing its profitability say its location, favourable contracts, access to supplies and customer loyalty, etc. Goodwill is the reputatio

3 min read

Accounting Treatment of Revaluation of Assets and Liabilities in case of Retirement of a PartnerThe value of Assets and Liabilities undergoes a change with the passage of time due to many reasons, like regular wear and tear, appreciation in the value of assets, bankruptcy of any debtor, and so on. In the Partnership firm, whenever a partner retires, it becomes necessary to revalue the assets a

7 min read

Accounting Treatment of Accumulated Profits and Reserves in case of Retirement of a PartnerWhen the firm is reconstituted all the accumulated profit, reserves and losses are transferred to Partner's Capital Accounts (if capital is fluctuating) or Current Accounts (if capital is fixed) in their old profit-sharing ratio. This is done because the reserves or accumulated profits/losses belong

3 min read

Accounting Treatment of Workmen Compensation Reserve in case of Retirement of a PartnerWhat is Workmen Compensation Reserve?Workmen Compensation Reserve is the reserve created out of profits to meet the needs of employees or workers. An amount is kept aside in the reserve in name of workers to meet the unforeseen situation. A claim can or cannot be made against this reserve. Accountin

4 min read

Accounting Treatment of Investment Fluctuation Fund in case of Retirement of a PartnerA reserve that is created out of profit to meet the change in the market value of the investment is termed an Investment Fluctuation Fund. Simply put, an amount is kept aside in the reserve in name of fluctuation to meet the changes in the value of the investment. The difference between the book val

6 min read

Accounting Treatment of Partner's Capital Account in case of Retirement of a Partner (Fixed Capital)A distinct account that records all the transactions between the Partnership firm and the partners to figure out the share of each partner in the firm at the end of the accounting period is known as the Partner's Capital Account. Every transaction right from the initial capital investment to their e

5 min read

Accounting Treatment of Partner's Capital Account in case of Retirement of a Partner (Fluctuating Capital)A Partner's Capital Account is a separate account that records all the transactions between the Partnership firm and the Partners in order to determine the share of each partner in the firm at the end of the accounting period. All the capital investments made by the partners are credited, and drawin

5 min read

Settlement of Amount due to a Retiring Partner when Full Amount is PaidWhen a partner retires from the firm, the firm is reconstituted. The firm continues its business with a change in the profit-sharing ratio. The account of the retiring partner is settled by either paying immediately the amount due to him/her or transferring the due amount to his/her loan account. If

4 min read

Settlement of Amount due to a Retiring Partner: Amount Paid in InstalmentSometimes the retiring partner may agree to receive the settlement amount in instalments instead of taking the full amount at once. The principal amount is then paid in an agreed number of instalments, and the settlement amount in such cases is transferred to the Retiring Partners' Loan Account. The

2 min read

Settlement of Amount due to a Retiring Partner: Transferred to Loan AccountA Retiring Partner is entitled to receive an amount of his share in the partnership firm after making all the adjustments related to goodwill, profit/losses, reserves, and accumulated profits, salary, commission, interests, and drawings. Such an amount can be paid to the retiring partner immediately

3 min read

Adjustment of Capital Account in case of Retirement of a PartnerWhenever a partner retires, the capital of the remaining partners is changed. As a result of this, some partners may have to bring in desired additional capital to fill in the deficit of their capital and some may have to withdraw the excess capital to match the requirement. The partners in the case

8 min read

Reconstitution of a Partnership Firm in case of Death of a PartnerOn the death of a partner, the partnership comes to end. The death of a partner does not mean the firm comes to an end as the partnership firm is a separate entity from the partners. After the death of a partner, the firm continues its operation, and the remaining partner acquires a share of the dec

4 min read

Calculation of Share of Profit up to the Date of Death of a PartnerA deceased partner's legal executors are entitled to receive a share of the profit until the death date of the deceased partner. Such profits are calculated from the date of the last Balance Sheet of the firm till the date of the death of the partner. As per the Indian Partnership Act 1932, the acco

4 min read

Adjustment of Interest on Deceased Partner's Capital, Deceased Partner's Share in Goodwill and Accumulated Profits and ReservesSimilar to the case of retirement, the Executor of the deceased partner is entitled to receive the interest on capital up to the date of the death of a partner. The executor is also entitled to get a share of Goodwill and Accumulated profits and reserves.1. Adjustment of Interest on Deceased Partner

4 min read

Accounting Treatment of Revaluation of Assets and Liabilities in case of Death of a PartnerWhat is Revaluation of Assets and Liabilities?The value of Assets and Liabilities undergoes a change with the passage of time due to many reasons, like regular wear and tear, appreciation in the value of assets, bankruptcy of any debtor, and so on. In the Partnership firm, whenever a partner retires

7 min read

Accounting Treatment of Accumulated Profits and Reserves in case of Death of a PartnerWhen the firm is reconstituted all the accumulated profit, reserves and losses are transferred to Partner's Capital Accounts (if capital is fluctuating) or Current Accounts (if capital is fixed) in their old profit-sharing ratio. This is done because the reserves or accumulated profits/losses belong

4 min read

Accounting Treatment of Workmen Compensation Reserve in case of Death of a PartnerWhat is Workmen Compensation Reserve?Workmen Compensation Reserve is the reserve created out of profits to meet the needs of employees or workers. An amount is kept aside in the reserve in name of workers to meet the unforeseen situation. A claim can or cannot be made against this reserve. Accountin

4 min read

Accounting Treatment of Investment Fluctuation Fund in case of Death of a PartnerWhat is Investment Fluctuation Fund?A reserve that is created out of profit to meet the change in the market value of the investment is termed an Investment Fluctuation Fund. Simply put, an amount is kept aside in the reserve in name of fluctuation to meet the changes in the value of the investment.

6 min read

Accounting Treatment of Partner's Capital Account in case of Death of a Partner (Fixed Capital)Capital is the amount contributed by the partners in the firm. Partner's capital shows equity in a partnership that is owned by specific partners. It records the initial and subsequent contribution made by each partner and also the withdrawal made by the partner. Partner's Capital Account shows the

6 min read

Accounting Treatment of Partner's Capital Account in case of Death of a Partner (Fluctuating Capital)Capital is the amount contributed by the partners in the firm. Partner's capital shows equity in a partnership that is owned by specific partners. It records the initial and subsequent contribution made by each partner and also the withdrawal made by the partner. Partner's Capital Account shows the

5 min read

Accounting Treatment of Amount Due to Deceased PartnerAfter making all the adjustments related to the partners, the balance due to the deceased partner is transferred to his/her executor's account. This amount is paid to the executor in either of the following ways:1. Lump-sum in a single instalment:Under this method of payment, the full amount due to

3 min read

Accounting Treatment of Joint Life Policy in case of Death of a PartnerWhat is Joint Life Policy?Joint Life Policy like any other life policy gives coverage against the death of the policyholder, however, under Joint Life Policy the coverage is of a minimum of two persons and the pay-out is on a first-death basis. In the Partnership firm, the partners may hold the Join

4 min read

Accounting Treatment of Individual Life Policy in case of Death of a PartnerThe firm may insure the life of the partners individually instead of taking a Joint Life Insurance. When the premium of the Individual Life Policy is charged against the Profit and Loss Account of the firm, then the Insured Amount is treated as the gain for the partners. So, the Representative of th

3 min read

Chapter 5: Dissolution of Partnership Firm

Difference between Dissolution of Firm and Dissolution of PartnershipA Partnership is an association of two or more people to conduct business. A Partnership is a relation between persons who agreed to share the profits of a business carried on by all or any of them acting for all. Partners are someone who is associated with another in a common activity or interest,

3 min read

Difference between Firm's Debt and Private DebtDebt is a liability that necessitates one party, the debtor, to pay another party, the lender, money or other consented value. Debt is a delayed payout, or set of payments, as opposed to an instant rebate. It is an important concept in the context of business finance and accounting. The separate ent

3 min read

Difference between Realisation account and Revaluation accountWhat is Realisation Account?At the time of dissolution of the Partnership firm, Assets are realised, outside liabilities are paid, loan by partner is repaid and the balance, if any, is distributed among the partners. Realisation account is prepared to close the books of accounts by realising assets

4 min read

Accounting treatment of Accumulated Profits, Reserves, and Losses in case of Dissolution of FirmAccumulated profit refers to a part of the firm's net profit that is preserved by the firm for future growth. It is also known as retained earnings or undistributed income. Accumulated profits and reserves show the financial position of the company in the long run in terms of earning, saving, and in

5 min read

Dissolution of Firm: Partner's Capital AccountWhat is Dissolution of a Firm?Dissolution of the firm is the discontinuation of the business and closure of all the books of accounts of the firm. Dissolution of the partnership means a change in the profit-sharing ratio of the existing partners in the firm and the business or the firm continues its

4 min read

Dissolution of Partnership Firm: Meaning and ExampleWhat is Dissolution of a Partnership Firm?Dissolution of the firm means dissolution of the partnership among the partners of the firm. The business is closed, and an end comes to the business relationship among partners on the dissolution of the firm. The firm is dissolved either by a court order or

2 min read

Accounting Treatment of Goodwill in case of Dissolution of FirmGoodwill is nothing but a monetary value of a reputation of a business firm in the market, earned by the firm by serving its customers. In a Partnership firm, Goodwill is treated like an asset; every partner has a right over the firm's goodwill up to his/her share in the business.In case of the Diss

2 min read

Accounting Treatment of Joint Life Policy in case of Dissolution of a FirmWhat is Joint Life Policy?Joint Life Policy is a life policy that gives coverage against the death of the policyholder, under which the coverage is of a minimum of two persons and the pay-out is on a first-death basis. Since the Partnership firm is a business run by at least two people, the partners

3 min read

Accounting Treatment of Contingent Assets and Contingent Liabilities in case of Dissolution of a firmContingent Assets: A Contingent Asset is an economic gain that may come into existence in near future as a result of some past action. The existence of such assets is completely uncertain and beyond the control of the entity. Example: Any property of a firm under some legal suit, and warranty receiv

3 min read

Part-B

Chapter 1: Accounting for Share Capital

Company and its TypesA company is one of the most important and prominent forms of business organization. It can be described as a voluntary association of individuals, having a common purpose, who agree to pool their funds and unite to achieve the said goals. It can be called an artificial person created under the juri

7 min read

Shares : Meaning, Nature and TypesWhat are Shares?When the total capital of the company is divided into units of small denominations, it is known as shares. For example, if the total capital of the company is ₹ 5,00,000, divided into 10,000 units of ₹50 each, each unit of ₹50 will be called a share (of ₹ 10 each). Thus, in the above

5 min read

Difference between Preference Shares and Equity SharesLife-blood of any business is finance. Sufficient finance for the company helps to grow and expand the company. The financial needs of any business are concerned with the acquisition and utilisation of funds. It is done through planning, acquiring, utilising, managing, and controlling funds in conne

5 min read

Share Capital: Meaning, Kinds, and Presentation of Share Capital in Company's Balance SheetWhat are Shares?When the total capital of the company is divided into units of small denominations, it is known as shares. For example, if the total capital of the company is ₹ 5,00,000, divided into 10,000 units of ₹50 each, each unit of ₹50 will be called a share (of ₹ 10 each). Thus, in the above

5 min read

Difference between Capital Reserve and Reserve CapitalCapital Reserve and Reserve Capital are most often confused same. However, the former is a reserve created out of the Capital Profits of a firm; whereas, the latter is a part of the increased nominal capital or uncalled share capital of an organisation which shall not be called up, except in the eve

3 min read

Accounting for Share Capital: Issues of Shares for CashA unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,00

9 min read

Issue of Shares At Par: Accounting EntriesA unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,00

3 min read

Issue of Shares at Premium: Accounting EntriesA unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,00

4 min read

Issue of Share for Consideration other than Cash: Accounting for Share CapitalA unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,00

5 min read

Issue of Shares: Accounting Entries on Full Subscription with Share ApplicationA unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,00

2 min read

Calls in Arrear: Accounting Entries with Examples on Issue of SharesCalls in Arrear refer to the amount of money that a shareholder has not yet paid to a company on shares they have agreed to purchase. In the context of a company issuing shares, the payment for these shares is often requested in installments, known as "calls." If a shareholder does not pay an instal

4 min read

Calls in Advance: Accounting Entries with Examples on Issue of SharesCalls in Advance is the amount of future calls which is received by the company in advance. Calls in Advance is just opposite to Calls in Arrear. It is a situation when the shareholders of a company pay the amount not yet called upon their shares. Section 50 of the Companies Act, 2013 says that the

4 min read

Oversubscription of Shares: Accounting TreatmentA unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,00

4 min read

Oversubscription of Shares: Pro-rata AllotmentA unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,00

4 min read

Oversubscription of Shares: Pro-rata Allotment with Calls in ArrearA unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,00

5 min read

Forfeiture of Shares : Accounting Entries on Issue of SharesWhat is Forfeiture of Shares?Cancellation of shares of a shareholder who fails to pay the amount due on allotment or on any call within the specific time period is known as Forfeiture of Shares. A company or its directors can forfeit the shares only if its Articles of Association allow for the same.

5 min read

Accounting Entries on Re-issue of Forfeited SharesA unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,00

7 min read

Disclosure of Share Capital in the Balance Sheet: Accounting Entries on Issue of SharesA unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share. Simply put, shares are the denominations of the share capital of an organisation. For example, if the total capital of ABC Ltd. is ₹10,00,00

3 min read

Chapter 2: Issue and Redemption of Debentures

Issue of Debentures: Meaning, Characteristics, Purpose of Issuing Debentures and ExampleA debenture can be described as a debt instrument issued by a company to the public in order to raise funds for medium or long-term usage. It is just like a bank loan, with debt obligation and liability for interest payment, but instead of borrowing from a bank, these are issued and traded in the ca

5 min read

Types of DebenturesWhat is Debenture?A debenture can be described as a debt instrument issued by a company to the public in order to raise funds for medium or long-term usage. It is just like a bank loan, with debt obligation and liability for interest payment, but instead of borrowing from a bank, these are issued an

4 min read

Difference between Shares and DebenturesIssuing of Shares and Debentures are two of the most prominent source of finance for any business. By issuing shares and debentures, any public company can generate finance from the market. Finance required by the business to establish and run its operations is known as Business Finance. No business

4 min read

Issue of Debentures: Accounting Treatment of Issue of Debenture and Presentation of debentures in balance sheet (with format)What is a Debenture?A written instrument or document which is issued by the company acknowledging the borrowings is known as Debenture. In this document, the terms of repayment of principal and payment of interest at a specific rate are stated. According to Section 2(30) of the Companies Act, 2013,"

2 min read

Issue of Debenture at Par and PremiumWhat is a Debenture?A written instrument or document which is issued by the company acknowledging the borrowings is known as Debenture. In this document, the terms of repayment of principal and payment of interest at a specific rate are stated. According to Section 2(30) of the Companies Act, 2013,"

3 min read

Issue of Debentures for Consideration other than CashIssue of Debentures for consideration other than cash means that the company has not received amount (in cash or by cheque) against the debentures issued. Debentures may be issued for consideration other than cash in the following situations:To promoters of the company for rendering services for inc

4 min read

Issue of Debenture as Collateral SecurityWhat is Issue of Debentures as Collateral Security?A company may have to issue debentures as a subsidiary or secondary security in addition to the principal security when it takes a loan from a bank or from other party, this is known as Issue of Debentures as Collateral Security. Collateral security

3 min read

Interest on DebenturesA debenture can be described as a debt instrument issued by a company to the public in order to raise funds for medium or long-term usage. It is just like a bank loan, with debt obligation and liability for interest payment, but instead of borrowing from a bank, these are issued and traded in the ca

3 min read

Redemption of DebenturesWhat is Redemption of Debentures?Repayment of debentures to the debenture holders or discharge of the liability on account of debentures is known as the redemption of debentures. They are normally redeemed at the expiry of the period for which they were originally issued. The company may also redeem

4 min read

Redemption of Debentures: Meaning, Sources and Rules regarding RedemptionWhat is Redemption of Debentures?Repayment of debentures to the debenture holders or discharge of the liability on account of debentures is known as the redemption of debentures. They are normally redeemed at the expiry of the period for which they were originally issued. The company may also redeem

5 min read

Redemption of Debentures in case of Lump-SumWhat is Redemption of Debentures?Repayment of debentures to the debenture holders or discharge of the liability on account of debentures is known as the redemption of debentures. They are normally redeemed at the expiry of the period for which they were originally issued. The company may also redeem

3 min read

Redemption of Debentures in case of InstallmentWhat is Redemption of Debentures?Repayment of debentures to the debenture holders or discharge of the liability on account of debentures is known as the redemption of debentures. They are normally redeemed at the expiry of the period for which they were originally issued. The company may also redeem

2 min read

Redemption of Debentures in case of Purchase of Own DebenturesWhat is Redemption of Debentures?Repayment of debentures to the debenture holders or discharge of the liability on account of debentures is known as the redemption of debentures. They are normally redeemed at the expiry of the period for which they were originally issued. The company may also redeem

4 min read